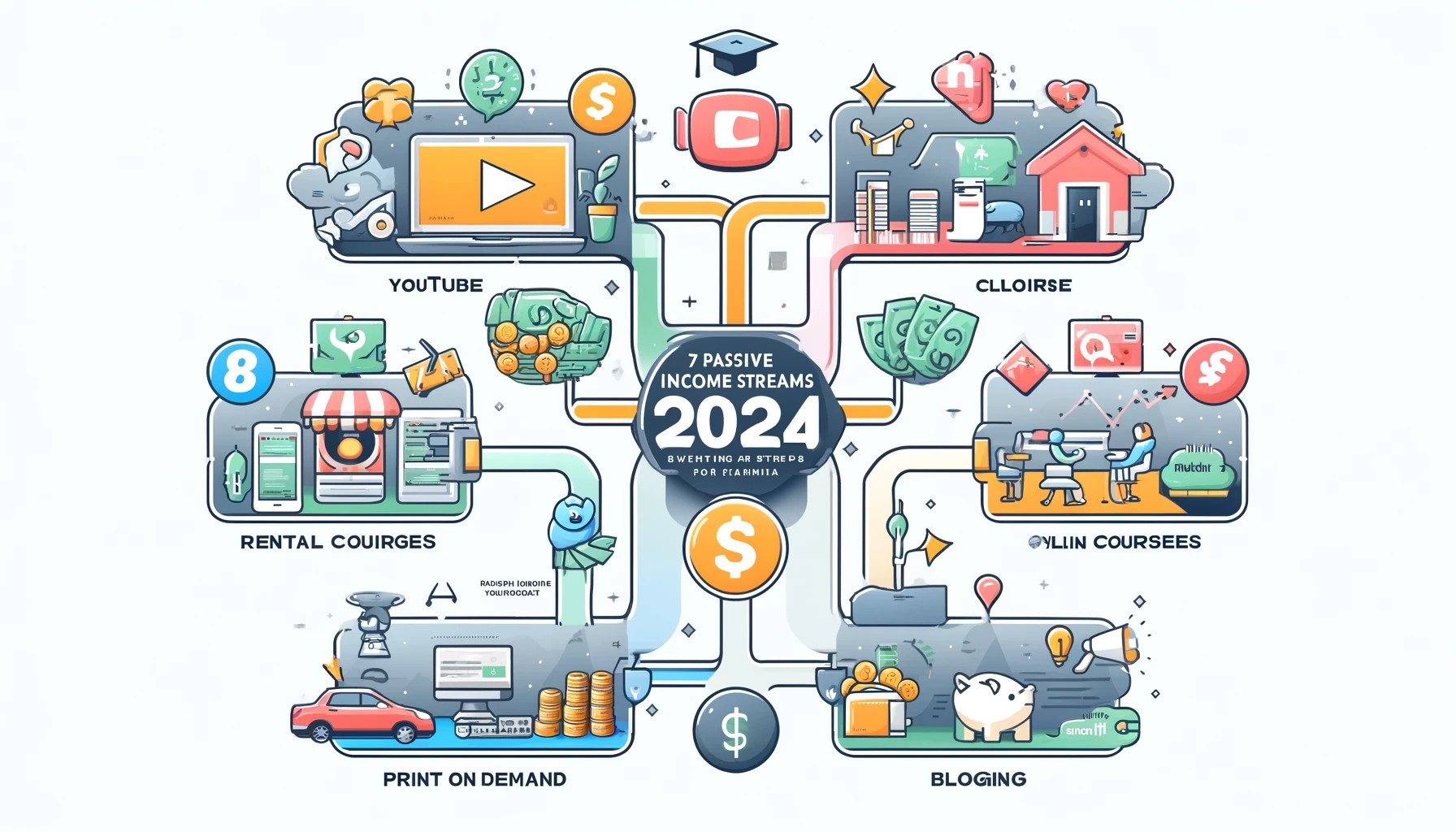

7 Passive Income Streams You Must Know in 2024

Introduction

Passive income—everyone wants it, right? Who wouldn't love to relax at home while money flows into their bank account? But before enjoying this lifestyle, you need to invest a lot of time and effort to build a stable passive income system. Today, let's talk about 7 passive income streams you shouldn't miss in 2024.

1. YouTube

YouTube is a platform full of opportunities, with multiple ways to monetize. Besides the common ad revenue, you can establish membership systems, sell eBooks, or offer online courses. Creating a 10-15 minute video typically takes around 20 hours, but once published, it can continuously generate income.

YouTube ad revenue is calculated as CPM (cost per thousand impressions) multiplied by views, then divided by 1000. Different channels and niches have varying CPMs. For example, finance-related channels have higher CPMs, around $7.5-10, while lifestyle vlogs might have CPMs of $2.5-5. On average, CPM is about $5. To earn $1000 a month, you’d need around 200,000 views.

Related Link: How to Make Money on YouTube

2. Online Courses

The online course market is booming, expected to reach $350 billion by 2025. Creating a high-quality online course requires initial effort, but once completed, you need only to market and handle orders. Platforms like Udemy and Teachable are excellent for selling courses, or you can sell through your own website.

These platforms have established reputations and can save you significant marketing effort. However, platforms like Udemy often cap course prices, usually under $50. If you sell through your website, you have pricing flexibility but must handle all marketing and traffic generation.

3. Rental Properties

Rental properties are a classic source of passive income. Even if you only own your primary residence, you can consider renting out a room or basement for extra income. In the US, a well-finished basement can rent for $1500-2000, while a room might go for $500-1000.

Investing in rental properties requires capital, but it doesn’t demand as much time and effort as creating videos or courses. If you lack the funds to buy additional properties, start by renting out a part of your home. This strategy can help reduce mortgage pressure and provide a steady cash flow.

4. Stock Investments

While the stock market carries risks, with proper knowledge and tools, you can predict trends and earn money. The US stock market is relatively transparent, and with sufficient learning, long-term gains are achievable.

Remember, stock investing requires knowledge and experience. Don’t blindly follow others' recommendations. Ensure you understand why you’re investing in a particular stock. Even if you incur losses, knowing the reasons helps you avoid similar mistakes in the future.

5. Print on Demand

Print on demand (POD) is a no-inventory business model where you design and upload your creations, and the platform handles the rest. Popular items include T-shirts, phone cases, and mugs. If your designs become hits, you can enjoy continuous earnings.

POD websites like Printful and Redbubble offer various products. Focus on creating and uploading your designs. Once someone places an order, the platform manages production, shipping, and customer service. You just wait for the income to roll in.

6. Blogging

Blogging remains popular in the US. With Google AdSense, you can monetize your blog by displaying ads. When visitors click on these ads, you earn money. Successful blogs usually focus on solving problems for a specific audience, continuously providing valuable content.

The key to a thriving blog is selecting a niche with demand and regularly posting high-quality content. Over time, as your blog traffic grows, so will your ad revenue. Besides ads, you can also earn through affiliate marketing and product promotions.

7. Savings

While savings alone won’t make you wealthy, it’s a risk-free way to earn some passive income. US fixed deposit rates are typically around 4%-5%, providing a stable return without much effort.

Banks often have promotional offers with higher interest rates for specific periods. By keeping an eye on these offers, you can maximize your interest earnings with minimal risk and effort.

Wrap-Up

Building passive income streams requires upfront investment, but once set up, they provide ongoing returns. Choose one or more methods that suit your interests, skills, and resources to gradually achieve financial freedom. In 2024, don't miss out on these passive income opportunities—start taking action now!

FAQs

-

Does passive income really require no work?

- It requires significant time and effort upfront. Once the system is established, you can enjoy passive income.

-

How do I choose the right passive income method for me?

- Consider your interests, skills, and resources to select the most suitable method.

-

How much capital is needed to start renting properties?

- It varies. You can start by renting out a room or basement in your home.

-

What qualifications are needed to create an online course?

- You don’t need to be an expert; practical experience and valuable insights in a particular field are enough.

-

Can blogging still be profitable?

- Yes, it can. Focus on a specific niche and provide valuable content consistently.

Related Links

I hope this article helps you find the right passive income methods and achieve financial freedom!